Major reforms for Australian mergers

A Competition Review commissioned by the Australian Government has proposed significant changes, in part bringing Australia in line with international practice to take effect from 1 January 2026.

Whilst we await further details from the Treasury, with exposure draft legislation expected in the second-half of 2024, significant changes are clearly on the horizon.

ACCC as sole first-instance decision maker

The most significant of the proposed changes is limiting the current options available to parties, including to seek judicial determination to a first instance administrative decision-making process by the ACCC with review by the Tribunal. This reflects the Review’s view that the ACCC is best placed to be the primary decision maker in the merger control process as an expert in economic and market structure analysis. The reversal of onus proposed by the ACCC to require merger parties to satisfy the ACCC that a merger is not likely to substantially lessen competition has not been accepted by the Review, removing a potential for inbuilt systemic bias.

Thresholds and Mandatory Notification

Monetary turnover based thresholds will be introduced to trigger mandatory notification, with voluntary notification open for proposed mergers below the thresholds, notwithstanding the ACCC will not have ‘call-in’ powers for below threshold mergers.

A “creeping” acquisition notification trigger will also be introduced aggregating mergers over a three year period, together with other anti-avoidance measures.

If the threshold is met, merger parties will be required to provide a notification form and relevant information to the ACCC.

The effect of notification is that the dealings are effectively suspended pending the ACCC’s approval or dismissal of the transaction. Mergers must not proceed until the ACCC approves them, with or without conditions attached. Companies should understand that any merger or arrangement related to the merger which purports to be effective without the ACCC’s determination will be void.

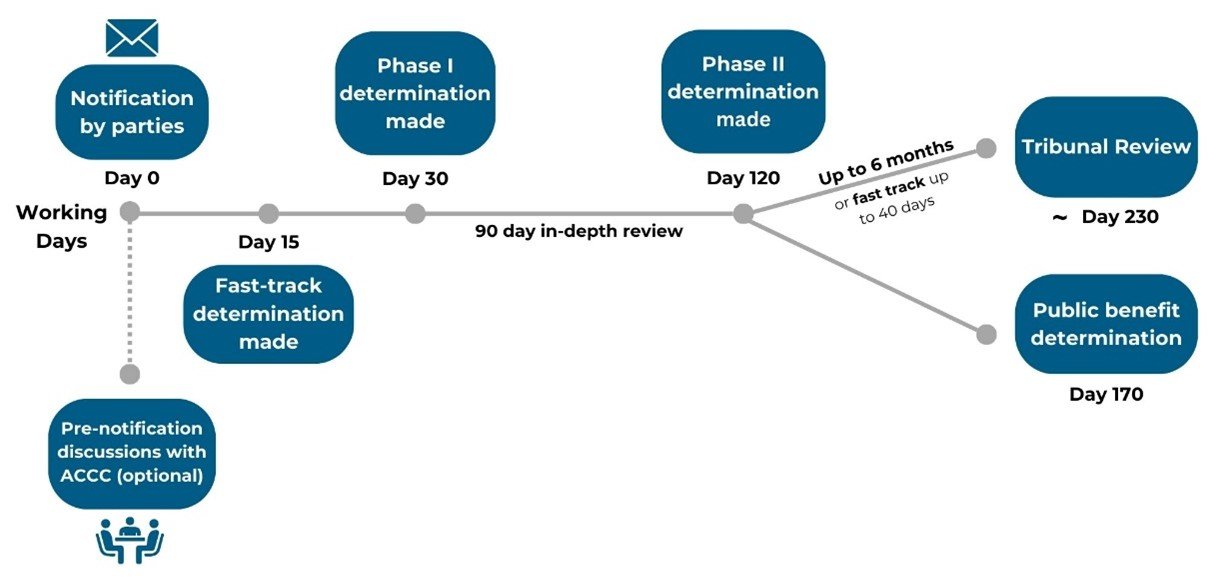

A ‘fast-track’ determination option will be made available for non-contentious mergers that nonetheless meet the threshold.

The Treasury has also indicated that fees of around $50,000-$100,000 will be imposed for all merger notifications. An exemption for small business has been foreshadowed.

Procedure

Following notification the Phase I determination will focus on whether the ACCC reasonably believes the merger would have, or would be likely to have, the effect of substantially lessening competition in any market, including if the merger creates, strengthens, or entrenches a position of substantial market power, an expansion of the current substantive test.

Unless the ACCC reasonably believes the merger would be anti-competitive, it must permit the merger to proceed. Where there are competition concerns, a more comprehensive Phase II review will commence. If a determination under Phase II disallows the merger, aside from complying with the order, a company as two options:

Review: seek Tribunal review of the ACCC’s determination.

Public Benefit Application: seek approval that the merger would result in a substantial benefit to the public which outweighs the anti-competitive consequences of the transaction.

Time Frames

The Treasury will set merger review timelines to limit delays and has published an indicative timeline.

Transparency

The ACCC will be required list all mergers it considers on the ACCC public register, not dissimilar to the current register. Any determination made by the ACCC must also be published.

The proposed changes represent significant reform, with significant details still to be finalised following further consultation.

Partner

T: + 61 3 9119 2585

E: adam.martin@nortonwhite.com

Address: Level 13, 459 Collins Street, Melbourne VIC 3000

Partner

T: + 61 3 9119 2535

E: alison.mckenzie@nortonwhite.com

Address: Level 13, 459 Collins Street, Melbourne VIC 3000

Solicitor

T: + 61 3 9119 2584

E: renay.sumercan@nortonwhite.com

Address: Level 13, 459 Collins Street, Melbourne VIC 3000